48+ how much mortgage interest can i deduct in 2021

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Publication 936 explains the general rules for.

Http Assets Mediaspanonline Com Prod 5476674 11272010 Sls A01 By Salisbury Post Issuu

Ad First Time Home Buyer.

. Out of the account. Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000 if. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Comparisons Trusted by 55000000. Web Interest expense. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

Ad 10 Best House Loan Lenders Compared Reviewed. Web How Much Mortgage Interest Can I Deduct. Get Instantly Matched With Your Ideal Mortgage Lender.

However higher limitations 1 million 500000 if married. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Homeowners can deduct interest expenses on up to 750000 of mortgage debt from their income taxes though when they itemize these.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Lock Your Rate Today. Above 109000 54500 if.

Web Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing separately. Web As noted in general you can deduct the mortgage interest you paid during the tax year on the first 750000 375000 if married filing separately of your mortgage debt for your. Web If you paid real estate taxes through an escrow account you can only deduct the amount that was actually paid.

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Use e-Signature Secure Your Files.

Try it for Free Now. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The current tax law is scheduled to sunset in 2026.

750000 if the loan was finalized after Dec. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year.

Web Trumps Tax Cuts and Jobs Act of 2017 lowered the Mortgage interest deduction limit from 1000000 to 750000. If you took out your home loan before Dec. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

If you have a. From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to. Web If you buy a home in 2021 you can only deduct mortgage interest expenses on 750000 of mortgage debt said Mary Ford a certified public accountant.

To the taxing authority. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web If youve closed on a mortgage on or after Jan. Upload Modify or Create Forms. Discover Helpful Information And Resources On Taxes From AARP.

For tax year 2022 those amounts are rising to. Easily Compare Mortgage Rates and Find a Great Lender. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms.

Maximum Mortgage Tax Deduction Benefit Depends On Income

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Tax Calculator Nerdwallet

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Tax Deduction What You Need To Know

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Bankrate

Calculating The Home Mortgage Interest Deduction Hmid

How Much Mortgage Interest Is Tax Deductible

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Tax Deduction Calculator Freeandclear

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Bankrate

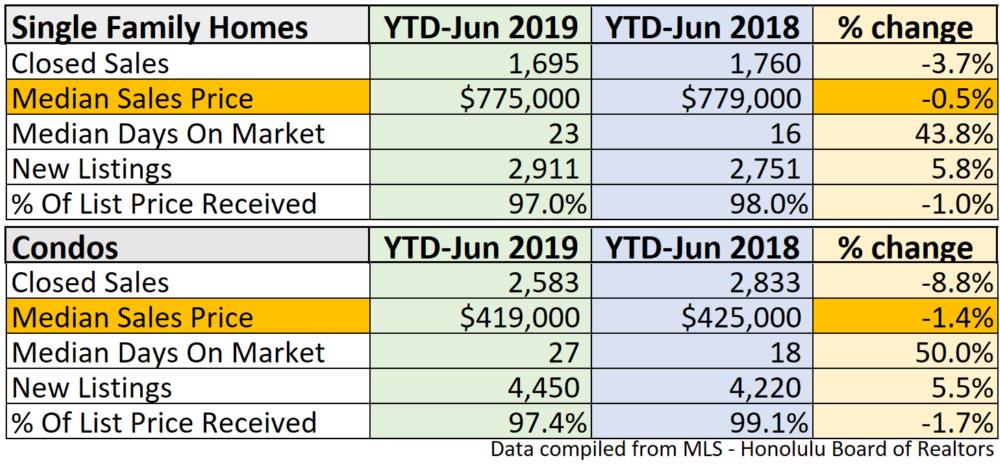

Oahu Real Estate Market Update 2019 Mid Year

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Tax Deduction What You Need To Know